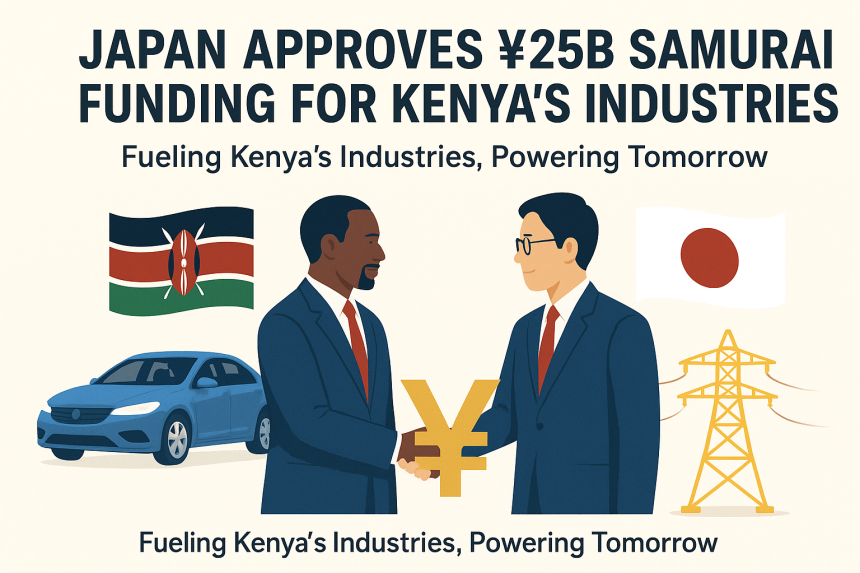

Kenya has obtained ¥25 billion in Samurai financing from Japan, valued at approximately $169 million. This financing package is part of Kenya’s broader effort to diversify funding sources while strengthening key industries.

The funds will be directed into vehicle assembly plants and energy transmission networks, sectors considered critical for industrial expansion. By enhancing vehicle assembly capacity, Kenya hopes to reduce reliance on imports, support local manufacturing, and open up new opportunities for small and medium enterprises linked to the automotive value chain.

In the energy sector, the financing will go toward upgrading transmission lines and reducing electricity wastage, ensuring more reliable power for households and businesses. Analysts say this will not only cut production costs but also attract more investors to Kenya’s industrial parks and special economic zones.

The deal is also expected to ease fiscal pressure on the government, which has faced tight budgetary constraints due to debt obligations and rising public spending. By turning to Samurai bonds—yen-denominated bonds issued in Japan—Kenya has tapped into an alternative market with favorable interest rates compared to traditional Eurobonds.

Experts believe this agreement highlights Japan’s growing role as a strategic economic partner for Kenya. Beyond financing, Japan has continued to support Kenya through technology transfer, industrial training programs, and infrastructure development.

Looking ahead, policymakers hope that such financing will be replicated across other priority areas, such as green energy and smart agriculture, to further boost Kenya’s resilience and competitiveness in global markets.