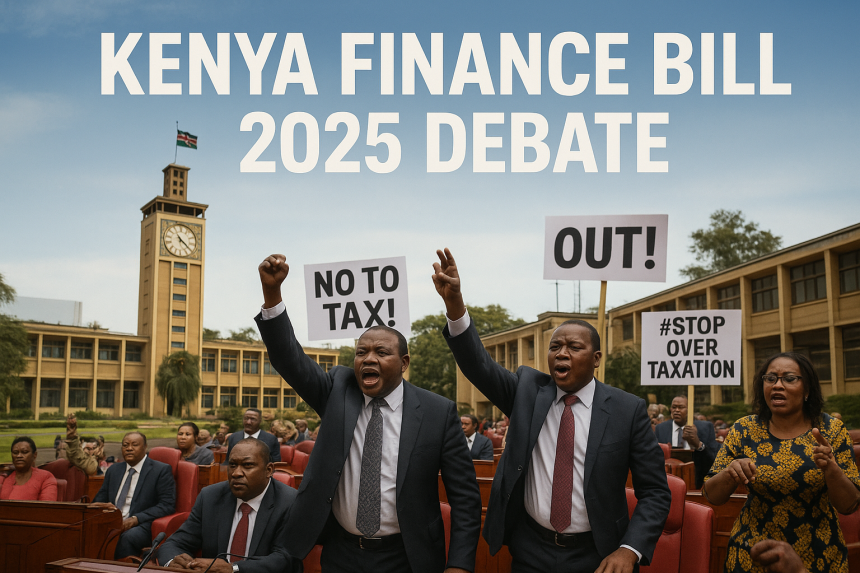

The Kenya Finance Bill 2025 has sparked heated debates in Parliament this week, with lawmakers deeply divided over its implications for the economy and ordinary citizens.

The proposed bill introduces a series of new tax measures, including:

-

A 2% levy on digital transactions

-

Increased excise duty on fuel

-

Higher VAT on household goods

Supporters of the bill, led by Treasury officials, argue that the new measures are necessary to boost revenue collection and reduce Kenya’s ballooning public debt. They claim that the reforms will strengthen the government’s capacity to fund key projects in healthcare, infrastructure, and education.

However, opposition MPs and civil society groups have strongly rejected the bill, warning that the additional taxes will increase the cost of living and push more Kenyans into financial hardship. Street demonstrations have already been reported in Nairobi, Kisumu, and Mombasa, with protesters calling for the withdrawal of the proposed tax hikes.

Economic experts have also weighed in, noting that while the bill aims to stabilize Kenya’s fiscal deficit, the timing may worsen inflationary pressures. Inflation currently stands at 8.6%, with food and fuel prices hitting historic highs.

Parliament is expected to vote on the Finance Bill later this month. Analysts predict a tight margin, with the possibility of amendments to ease public pressure.

The outcome of this debate is likely to have a major impact on Kenya’s political stability and economic outlook in 2025.